As we now slowly but surely head out of lockdown all auctions have now resumed working, albeit in an online method of sale only. Currently there is no possibility of buyers or vendors attending the auction sites on sale days because most cannot enforce the strict social distancing rules laid out by the Government.

Rather interestingly, one auction has managed to do this, at South Western Vehicle Auctions in Poole. The image below shows the sale getting underway in late May.

Usually packed with buyers, this scene shows just the auctioneer on the rostrum and 2 Vendors in attendance (including us), whilst all sales are conducted online or by telephone bid. It worked really well though, possibly because SWVA allow viewing of the stock by buyers two hours before the sale starts, so that they can at least check the stock over. Buyers are asked to leave the site an hour before the sale starts, to allow them time to set up their online bidding. Vendors are allowed to stay in the auction hall, to make instant decisions on when to sell.

We liken this scenario to supermarket shopping when one physically goes to a supermarket to shop, inevitably items are bought that were not on the list.

We shop with our eyes and often succumb to the supermarket ‘deals’. Compare that to an online supermarket shop, where we simply pick only the items we want, nothing else. Invariably cheaper to shop that way because we are not tempted. Apply this same process to auctions and it is easy to understand why online sales in isolation are not as successful as a joint physical/online sale.

SWVA’s approach of allowing buyers to view the stock physically (under very strict distancing and hygiene rules) really seemed to work, resulting in over 120 active online bidders at their sales.

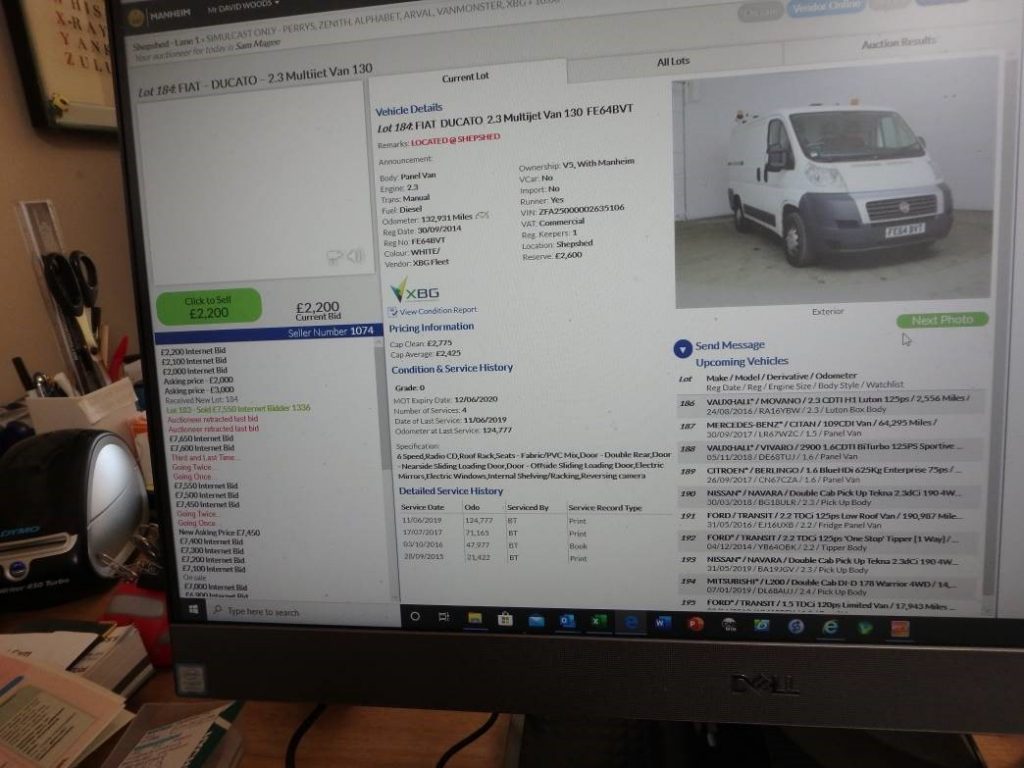

Throughout May and June the online sales seemed to work reasonably well around the country, with some great successes such as SWVA and, in a similar vein East Anglian Auctions in Norwich and Shoreham Auctions. Manheim also had some good sales with plenty of buyers online.

With Book prices having dropped from a high in February traders did return to market to stock their forecourts back up, having sold a few units during the lockdown. Even by the end of June demand remained very strong, with sales conversion rates at most sales being in excess of 80% and well in advance of CAP Average and in a lot of cases, in advance of CAP Clean.

We expect to see prices remain strong through to the end of August, subject to there being no further lockdowns following a potential second wave of the Covid19 virus. From September onwards, we believe that supply into the car and LCV markets will catch up with demand, causing prices to firm up and possibly even drop back. The good news is that Guide prices have remained firm during the early summer, after a significant drop in February into March.

The truck market has also started again and, like LCV’s sales are strong. Anything different is selling particularly well and we had some great successes this month with RCV’s, which made more money than they were pre-lockdown!

This front end recycler based on the ever popular Volvo FM 8×4 chassis easily sold past it’s book values, with plenty of bidders. Given the current deflated scrap market (for the bin equipment) it must be assumed that the truck is destined for conversion to a tipper or similar, or even export once port space allows.

Plant and equipment sales had been affected by the lack of export ability, with only certain items making their mark during early lockdown. Export is getting easier though as port facilities gear up again around the country. The real difficulty in this market is any lack of guide pricing, with only comparable pricing to go by.

Thus we are very careful not to simply accept the first bid that comes along, weighing up if it is reasonable (given any past sales) or, at the very least working hard for an increase.

However sometimes the bid is instantly good, such as this 2010 registered McCormick tractor, which sold extremely well at Brightwell’s recent online sale.

Generally speaking with plant, auctions typically sell the items ‘as seen. If a buyer cannot see the item and test for serviceability they will bid assuming something is wrong with it. That can lead to lower pricing but, with our live online presence and post-sale negotiation, we are managing to get past this lack of buyer confidence.

This does prove that there is no substitute for ‘being there’ at the sale!

Once vehicle manufacturing gets back to full strength this situation will return to normal.

Older LCV stock such as Connect and Transit vans always do well in harder economic times because they appeal to both traders and private buyers. Traders can afford to buy 2 older vans for the price of one newer van and enjoy double the profit margin.

Rostrum Management and ‘Profit’

If ever there was a time to justify rostrum management now is that time!! With every sale currently being restricted to online only, we are managing all of them remotely (except SWVA), but live online. As well as being able to get stock ‘on sale’ at the best time, a major part of our job is now turning to post-sale negotiations, to get the right prices for the stock. It is imperative that every sale is managed in this way.

Market News

With pretty much all major Manufacturers having shut down production during the enforced lockdowns around the world, sales of new models have stopped. As with the used markets though, the minute lockdown began to ease, dealers were keen to engage with customers to get new vehicles out there and, manufacturers too came to the party to tempt buyers in.

Renault for example began by offering the new Captur at 0% APR, £0 deposit and with a 5 year/100,000 mile warranty and breakdown assistance thrown in!

Thus Renaults strap line of ‘Just Drive’ is certainly near the truth although, clearly they are seeking to earn from the finance opportunities.

Other Manufacturers will follow suit in an effort to get the sector moving again and, of course to begin clearing the backlog of parked cars and vans in various storage locations around Europe.

All of this could deflect interest away from the used markets, but the uncertainty surrounding employment, the wider economy and the possibility of the virus sweeping back through Europe into winter 2020 will deter many buyers from committing to a new vehicle. Many will seek to sustain their mobility, be it for personal or business use by buying a second hand unit which represents far less of a financial risk.

This is certainly true for the LCV markets where many SME’s and self employed skilled trades will buy a used van to simply keep them going through these uncertain times. For this reason alone, the used markets generally perform very well indeed during recessions and wider economic and social issues, which is why we have seen such a storming start to trading coming out of lockdown.

New VW Caddy 5 Van

VW Commercials are still on track to introduce the revised Caddy van lineup early in 2021. As with most VW product this will be an evolution of the current model, rather than any revolution in design.

That said, the rear light cluster is certainly different, more akin to the Fiat and Ford small panel vans.

Interestingly, VW are launching the new van with 3 versions of the 2.0Tdi diesel engine with even further reductions in NOX emissions. A 1.5 petrol version completes the lineup which is devoid of any electric propulsion. A full EV has also been rejected by VW, citing the new ID Buzz Cargo that will carry the torch for electric power.

We do not believe this strategy will harm residuals for the new van which will be largely comparable (in money terms) to the existing models. There will of course be a premium to pay during the initial ‘honeymoon period’ but that will quickly disappear as more volume comes to the used markets.

Hydrogen Fuel Alternatives

We have spoken before about hydrogen fuelled vehicles, with Hyundai fairly well advanced in its passenger saloon offerings for the fuel. We have also before said that where the bus industry venture, other sectors eventually follow; the first hybrid buses were around nearly 10 years ago, long before the car and van industry widely adopted the technology.

Well here we are again, with the bus industry now firmly focused on hydrogen fuelled buses for the future. Orders for Wrightbus and Optare Hydrogen buses are increasing, with London, Belfast and some Scottish operators all taking batches to replace diesel engine vehicles.

The advantages over battery electric vehicles are the range and easy refueling, much like a diesel vehicle. Compare this to the electric bus which travels fewer miles on a full charge and takes a lengthy few hours to recharge, all of which is a hinderance to keeping buses on the road, earning their keep. And of course zero emissions.

So will the HGV and LCV industry follow suit? Yes, in time though as the current focus is most definitely on full EV operation. No doubt once the political interest changes towards hydrogen then Manufacturers will turn their attention to building vehicles capable of running on the fuel. It does seem a shame that so much energy has been given to electric and hybrid propulsion when, surely Hydrogen is the real future to mobility requirements?

Residual values for any hydrogen powered cars and vans are likely to be a challenge for the industry, certainly initially before any infrastructure is established. Does all this sound familiar?!